The following examples will clarify it further. In these examples investments is made at beginning of year 1 (or end of year 0) and returns are at the end of year 1 and year 2.

Example 1: Constant Dividend Growth and Dividend Yield remains constant

This example clearly shows that if yield remains constant then capital gains ((31.43/28.57)-1) is equal to the growth in dividend (10% in this case). Dividends provide adds another 3.85% (1.1/28.57) to the returns.

If the company does not pay any dividends then all the gains are due to capital gains. In this case it would be more useful to look at whether the returns are due to expansion in P/E multiple or due to growth in earnings.

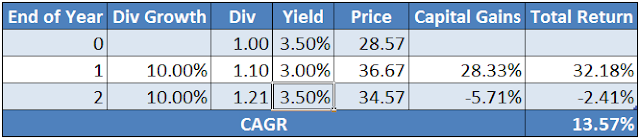

Example 2: Constant Dividend Growth and Dividend Yield Changes

In the first case the yield increases first and then decreases (3.5 --> 4 --> 3.5). In the second case the yield decreases and then increased (3.5 --> 3 --> 3). Note that CAGR is highest when yields go up and then down as compared to if yields were constant or if yields go down then up.

Let us see what will happen to SPY (ETF following S&P500 index) returns if the dividend yields go back to historical levels

Here is a chart of dividend yields of SPY (http://buyupside.com/dividendyieldchart/dividendyieldchartdisplay.php?symbol=SPY)

And here are the actual dividends

The yields went from around 3.5% in 1993 to around 1.75% in 2002 and to around 2% in 2011

Dividends grew at annual rate of 2.66% from 1993 to 2002 and at 6.21% from 2002 to 2011.

This is how the returns shaped up:

Over long term yields should mean revert and go back up to around 3% and dividend growth should revert and go down to its mean of around 4%. This will have serious negative drag on the stock returns. Thus, if you are saving for retirement, college it is important to understand that the stock returns may not be what you might expect looking at historical returns.

Now this may not actually happen dividends may continue to grow at a rate higher than 4% and yields may go down even further. Consider this as a worst case outcome.

No comments:

Post a Comment